The rapid development of information and communication technology (ICT) means that on the one hand, information gathering gets cheaper and easier, and on the other, the cost of making mistakes based on poor or late information tends to grow. For example, a costly project implementation program may spell trouble for a company if the project fails due to faulty costing or pricing that does not recognise fluctuations in demand that impact the level of resources required to deliver the project during implementation phase.

A good example of an activity for which resources can be added or removed in real-time based on the demand for services is that of Amazon Web Services (AWS). The resources provided by the company. can be increased by increasing the capacity given to a customer on its ‘cloud based on the web-traffic of the customer who demands its services. This volatility in resource demand and service delivery affects the cost and price of delivering those services in real-time. Thus, the demand for cost management systems that are capable of making use of organisational ICT capacities to deliver cost and price information in real-time continues to grow as global competition gets more and more tough.

The optimum accounting system today would: (a) require more information; (b) process more data; and (c) have more analyses available in real-time. Two real-time cost management systems that are very dependent on advanced technologies are Resource Consumption Accounting and Granular Costing.

Cost Attachment vs. Cost Allocation

Today’s cost accounting and cost management systems have various systems of attaching direct costs and allocating indirect costs to cost objects at various segmental levels such as: (a) products and services; (b) customers and marketing segments; (c) white-collar departments; (d) divisions and territories, etc. It is in the cost allocating of indirect (shared) costs that most problems arise.

Only direct costs at each segmental level were ‘attached’ to the cost objects. To get a full picture of costs being incurred, the indirect costs had to be ‘allocated’ to the cost objects (e.g., products or services). [1]

‘Traditional’ cost allocation systems allocate indirect costs using volume-based cost drivers such as ‘direct labour hours’ or ‘direct material costs”. In contrast, ‘Activity-Based’ cost allocation systems use both volume and non-volume cost drivers based on activities undertaken.

However, due to the lack of sophistication in available technology, resource costs and activities were often captured at the macro level (in ‘Activity Pools’). This then required the use of ‘cost drivers’ to allocate indirect costs to cost objects.

With the advent of sophisticated ERP applications, it is now possible to attach more resource costs to cost objects as direct costs, rather that classify them as ‘indirect costs’ and then use a cost driver to allocate to cost objects.[2]

Resource Consumption Accounting (RCA)

One technologically driven costing approach is called Resource Consumption Accounting (RCA). RCA is a sophisticated approach at the upper levels of the continuum of costing techniques with the ability to derive costs directly from operational resource data, or to isolate and measure unused capacity costs. [3]

The RCA model has been developed as a costing model for use with comprehensive computer-based Enterprise Resource Planning (ERP) systems. In the RCA approach, resources and their costs are considered as foundational to robust cost modelling and managerial decision support because an organisation’s costs and revenues are all a function of the resources and the individual capacities that produce them.

ERP systems can obtain real-time resource costs and activities data at a much more transactional (foundational) level.

Granular Costing

This is an extension of RCA where the resource costs and activities data are collected at a more granular level than even the transactional (foundational) level. The term ‘granular costing’ refers to the practice of breaking down costs into smaller, more detailed components. This approach allows for a more precise understanding and analysis of both direct and indirect expenses within a particular project, product, or business process. By examining costs at a granular level, organisations can gain insights into the factors that drive expenditure and make informed decisions about resource consumption, pricing, budgeting, and profitability.

The exact methods and techniques used in granular costing can vary depending on the context. It may involve identifying and categorising various cost elements, such as direct materials, labour, overhead, or specific cost drivers, to better track and allocate expenses.

Granular Costing in Project Management

Analysing costs and revenues at a granular level of detail can help organisations identify areas of inefficiency, cost-saving opportunities, or understand the true costs associated with different activities. Take the case of ‘project management’. Breaking up a project into granular activities involves a process called ‘Work Breakdown Structure (WBS)’. The steps to create a detailed breakdown of project activities are as follows:

- Identify the Project Deliverables: Start by understanding the project’s overall objectives and deliverables. These are the final outcomes or results that the project aims to achieve.

- Decompose Deliverables into Major Components: Break down the deliverables into major components or phases. These are the high-level divisions of work that contribute to achieving the project’s objectives.

- Break Down Major Components into Subcomponents: Take each major component and further break it down into smaller subcomponents or tasks. These tasks should be distinct and manageable units of work.

- Continue Breaking Down Tasks: Keep breaking down the tasks into smaller, more specific activities. The goal is to reach a level where each activity can be easily understood, estimated, assigned, and tracked.

- Define Activity Descriptions: Provide clear descriptions for each activity to ensure a shared understanding of what needs to be done. Include information such as task objectives, inputs, outputs, and any specific requirements or constraints.

- Estimate Duration and Effort: Estimate the time and effort required for each activity. This can be done using historical data, expert judgment, or by consulting team members familiar with the work. This information will also be available in the ERP system for those companies with significant experience in project management.

- Sequence Activities: Determine the logical order in which the activities should be performed. Identify dependencies between tasks, such as tasks that need to be completed before others can start (predecessor tasks) or tasks that can run in parallel.

- Assign Resources: Identify the resources (e.g., individuals, teams, equipment) required for each activity. Assign responsibilities and determine who will be accountable for completing each task.

- Use a Hierarchical Structure: Organise the activities in a hierarchical structure, with major components at the top level and progressively detailed tasks at the lower levels. This structure helps in visualising the project’s scope and dependencies. Note that at this granular hierarchical level, the activities the resource costs will be direct to the associated cost object at that hierarchical level.

- Develop a Project Schedule: Use the activity breakdown, durations, and dependencies to create a project schedule or timeline. This will help in visualising the overall project timeline and critical paths.

- Review and Refine: Review the work breakdown structure with stakeholders and team members to ensure completeness and accuracy. Make adjustments as necessary based on their feedback and insights.

It is important to note that the level of granularity in breaking down activities may vary depending on the project’s complexity and the level of detail needed for effective planning and management. The WBS should provide enough information to facilitate estimation, scheduling, resource consumption, and tracking of progress throughout the project lifecycle. An ICT driven granular costing system will enable the organisation to track resource consumption in real-time and obtain demand related prices when required.

Granular Costing in Asset Register Management

Traditionally, purchased assets were recorded as a single entity in the Assets Register, either as a tangible asset (e.g., motor car) or an intangible asset (e.g., goodwill), and the depreciated or amortised over its “useful life”. However, with today’s technology, an asset can be broken down into its granular components; and then recorded separately with each component having a different ‘useful life’. For example, a car’s engine would clearly have a different useful life to its tyres. [More on this later].

Such a level of granularity typically involves analysing the various elements and expenses associated with a particular asset. The exact approach may vary depending on the type of asset and the specific context, but here are some general steps that can be taken:

- Identify the asset: Determine the specific asset that the organisation wants to break down into its components. This could be a physical item, such as a piece of machinery, or an intangible asset, like software or intellectual property.

- Determine the major cost categories: Identify the major cost categories or cost drivers associated with the asset. For example, if a piece of machinery is being analysed, the major cost categories might include: (a) purchase cost; (b) maintenance expenses; (c) energy consumption; and (d) disposal costs.

- Break down the cost categories: For each major cost category, further break it down into smaller components. This involves identifying the specific expenses that contribute to the overall cost in each category. For instance, if maintenance expenses are a major cost category, the cost accountant might identify labour costs, spare parts, repair services, and preventive maintenance as the granular components.

- Assign costs accurately: Assign the identified costs to the corresponding components. This may involve estimating or using available data to allocate costs based on usage, time, or other relevant factors. For example, if the cost of a software asset is being analysed, the cost accountant might allocate costs based on licenses, development hours, support services, and infrastructure requirements.

- Analyse and evaluate the components: Once costs have been identified and assigned, analyse each component to gain insights. Evaluate the significance of each component in relation to the total cost of the asset and assess how it impacts the overall expenses. This analysis can help identify areas where costs can be reduced or optimised.

- Track and monitor: Implement a system to track and monitor the granular components of the asset over time. This enables ongoing analysis and allows an organisation to assess the effectiveness of any cost-saving measures or changes made based on the breakdown.

Granular Level Depreciation of Tangible Non-Current Assets

The portion of the cost (or other value) of an asset charged to an accounting period is called depreciation where tangible assets are involved. The purpose of charging depreciation is to allocate the cost (or other value) of plant, (less any salvage value), over the periods during which it contributes to the organisation’s revenue-earning activities. The depreciation charge is treated either as an expense of the period or as part of the cost of products manufactured in a period.

The conventional practice has been to base the depreciation charge on the cost of the asset. However, some firms revalue at least some of their assets from time to time and base their depreciation charges on these revalued amounts. In this way, expenses and revenues would both be expressed in current terms.

The depreciation method chosen to allocate the cost (or other measure of service potential) of an asset should be the method which best reflects the rate of decline of future service potential. As a result, some depreciation methods are based on the passage of time and others are based on the output, or use, of the asset. Some of the more typical ways of allocating depreciation are the following: (a) straight-line method; (b) reducing-balance method; (c) ‘sum-of-the-years-digits’ method; (d) production-units method; (e) appraisal or inventory method; and the (f) annuity method.[4].

It must be noted that the charging of depreciation is a process of allocation of the cost of a non-current tangible asset; it is not a process of valuation. As non-current assets such as ‘plant and equipment’ are used in the activities of a firm, a portion of its cost should be charged against the revenue for each period.

If a plant is more heavily used in the current period than was expected, for example, by a change from one-shift to three-shift operation, the depreciation method should be flexible enough to increase the charge for depreciation, because the service potential is being used up more rapidly than was originally estimated. The flexibility of the depreciation charge is also required in a period in which management recognises that the life of the plant (its service potential) has been shortened by changes in technology or customer demand; adjustments which are material in amount need to be reported as an abnormal item in the financial statements.

Whilst this level of ‘flexibility’ in the depreciation charge is a step in the right direction, it is still based on a charge on the totality of the asset (e.g., a motor car) rather that its granular components whose ‘service potentials’ are being used up at different rates.

Granular Components of a Motor Car

Take for instance the granular level components of a motor car. Some common examples of granular components found in motor cars are given below, although it should be noted that the service potentials of the components can vary depending on the specific make, model, and design:

- Engine: The engine is a major component of a car and can be further broken down into various parts such as the cylinder block, pistons, crankshaft, camshaft, valves, fuel injectors, and intake/exhaust systems.

- Transmission: The transmission system includes components like the gearbox, clutch, torque converter, drive shafts, and differential.

- Suspension: The suspension system comprises components such as shock absorbers, springs, control arms, sway bars, and bushings.

- Braking System: The braking system includes components like brake pads, brake discs/rotors, brake callipers, brake lines, and the master cylinder.

- Electrical System: The electrical system consists of components such as the battery, alternator, starter motor, ignition system, wiring harnesses, and various sensors.

- Fuel System: The fuel system includes components like the fuel tank, fuel pump, fuel filter, fuel injectors, and the fuel lines.

- Exhaust System: The exhaust system comprises components like the exhaust manifold, catalytic converter, muffler, and tailpipe.

- Cooling System: The cooling system includes components such as the radiator, water pump, coolant reservoir, hoses, and thermostat.

- Steering System: The steering system consists of components like the steering wheel, steering column, power steering pump, tie rods, and steering knuckles.

- Interior Components: These include components such as seats, dashboard, steering wheel, pedals, controls, audio system, air conditioning system, and various interior trims.

- Exterior Components: These include the car’s body panels, doors, windows, windshield, headlights, taillights, mirrors, grille, and other exterior features.

These are just some examples of the granular level components found in a motor car. Each component can be further broken down into smaller parts or subsystems. The specific components and their arrangement can vary depending on the car’s design, technology, and manufacturer. However, we are very familiar with the concept that these very different components depreciate at different rates. Organisations recognising this, would have much better insights into their product (and services) costing and pricing decisions.

Granular Components of a Laptop or Desktop Computer

The granular level components of a laptop or desktop computer can vary depending on the specific model and manufacturer. A general list of components commonly found are:

- Processor (CPU): The central processing unit, which performs most of the calculations and executes instructions in the computer. Examples include Intel Core i5 or AMD Ryzen 7.

- Memory (RAM): Random Access Memory, which temporarily stores data that the CPU needs to access quickly. Typical sizes range from 4GB to 16GB or more.

- Storage: Hard Disk Drive (HDD) or Solid-State Drive (SSD) to store data, programs, and the operating system. SSDs are becoming more common due to their faster performance and reliability.

- Display: The screen or monitor that displays visual output. It can be an LCD (Liquid Crystal Display) or OLED (Organic Light Emitting Diode) panel, with various sizes and resolutions.

- Graphics Processing Unit (GPU): Handles rendering and displaying graphics, videos, and other visual content. Laptops may have integrated GPUs (part of the CPU) or dedicated GPUs (separate chip), such as Nvidia GeForce or AMD Radeon.

- Motherboard: The main circuit board that connects and allows communication between various components, including the CPU, RAM, storage devices, and peripherals.

- Keyboard and Touchpad: Input devices for typing and controlling the cursor on the screen.

- Battery: A rechargeable power source that allows the laptop to operate without being connected to an electrical outlet.

- Power Supply: An adapter or charger that supplies power to the laptop and charges the battery.

- Wireless Network Adapter: Enables wireless connectivity, such as Wi-Fi and Bluetooth.

- Audio Components: Speakers and audio processing hardware for sound output.

- Ports and Connectivity: USB ports, HDMI, audio jacks, Ethernet port, SD card slot, etc., for connecting external devices and peripherals.

- Operating System (OS): The software that manages the computer’s resources and provides a user interface. Examples include Windows, macOS, or Linux.

- Enclosure and Chassis: The external casing and structural frame that houses and protects the internal components.

- Cooling System: Fans, heat sinks, and thermal management components to dissipate heat generated by the CPU and GPU.

These days organisations like Dell Technologies (a pioneer in mass customisation) allows a prospective customer to design his or her own computer from a list of ‘component options’ (akin to a ‘Bill of Materials’) on its website. Once a prospect designs it, Dell will price it. Clearly, Dell’s costing systems are accessed by the company at the granular level when it quotes a price. If the prospect accepts the price, he or she becomes a customer.

Unfortunately, whilst many customers of Dell select from a list of ‘options’ in designing their laptop, they do not depreciate the components at different rates. In many jurisdictions, the laptop can be written-off fully in the first year. Whilst this may be negligible in small organisations, such write-offs can seriously distort product costs (cost of goods sold) and period costs (expenses) in large organisations. That is why it is emphasised that financial accounting calculations should not be considered in management accounting cost calculations.

Bill of Materials in Large Asset Purchases.

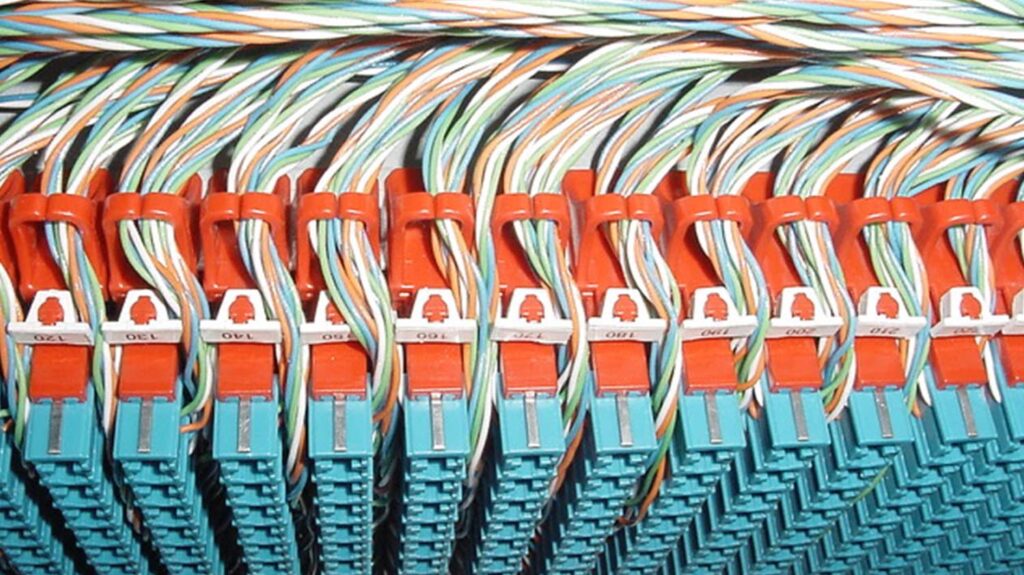

Unlike a laptop computer or even a motor car, in the case of large asset purchases, there will definitely be a Bill of Materials (BOM) that will be carefully considered prior to purchase. Let us take the example of a purchase of a local area ‘Electronic Telephone Exchange’ (asset) – also known as a telephone switch or private branch exchange (PBX), – by a telecommunications company.

The bill of materials (BOM) for an electronic telephone exchange can be quite complex and extensive. It involves various components and subsystems to enable the routing and switching of phone calls. A generalised list of components found in a BOM of an PBX are:

- Main Control Unit: The central processing unit (CPU) or main control board that manages the overall operation of the telephone exchange.

- Line Cards: Interface cards that connect the exchange to external telephone lines, such as analogue trunks (POTS) or digital lines (T1/E1, ISDN).

- Switching Matrix: A component that facilitates the switching and routing of phone calls within the telephone exchange. It connects incoming and outgoing lines, allowing calls to be directed to their destinations.

- Signalling System: The signalling subsystem responsible for call setup, routing, and teardown. This may include protocols like Signalling System 7 (SS7), ISDN (Integrated Services Digital Network), or Session Initiation Protocol (SIP).

- Control Software: The software responsible for call management, routing algorithms, and other functionalities of the telephone exchange.

- Power Supply Unit: Provides power to all the components within the telephone exchange.

- Voice Processing Units: Hardware modules or boards that handle voice processing tasks, such as analogue -to-digital and digital-to-analogue conversion, echo cancellation, voice compression, and voice quality enhancement.

- Digital Signal Processors (DSPs): Specialised processors designed to handle real-time voice processing tasks, such as voice compression (e.g., G.711, G.729) and echo cancellation.

- Redundancy and Failover Components: Systems and components that provide redundancy and failover capabilities to ensure high availability and fault tolerance of the telephone exchange.

- Control and Management Interfaces: Interfaces and components that allow administrators to configure, manage, and monitor the telephone exchange, such as a web-based management interface or a command-line interface.

- Enclosure and Chassis: The housing and structural frame that houses and protects the internal components of the telephone exchange.

- Cooling System: Fans, heat sinks, and thermal management components to dissipate heat generated by the active components.

- Network Interfaces: Ethernet or other network interfaces for connecting the telephone exchange to external networks or IP-based communication systems.

- Peripheral Interfaces: Interfaces to connect to external devices or systems, such as alarms, paging systems, or computer telephony integration (CTI) interfaces.

- System Documentation and Manuals: Documentation and user manuals that provide instructions for installation, configuration, and maintenance of the telephone exchange.

Rather than bring the purchase cost in at the asset level and use a single rate of depreciation, by using a BOM the asset can be broken in its granular components listed above. These individual components can then be depreciated according to the actual consumption of each component. This can then be compared with the revenues that come from minutes of talk, megabytes of data transfer, or an end-to-end successful service over those same granular-level components.

Summary

The rapid development of ICT enables organisations to develop technology-enabled ‘Real-Time Cost Management Systems’ for product costing and pricing purposes. Two cost management systems that are capable of utilising advanced ICT are Resource Consumption Accounting (RCA) and Granular Costing.

In the RCA approach, ERP systems are used to obtain real-time resource costs and activities data at a much more transactional (foundational) level than traditional and ABC cost allocation systems. Granular Costing is an extension of RCA where the resource costs and activities data are collected at a more granular level than even the transactional (foundational) level.

By breaking up assets into its granular components and analysing the associated costs, organisations can gain a more detailed understanding of the expenses involved. This information can inform decision-making processes, budgeting, resource consumption, and optimisation efforts.

References

[1} Rohit Sharma and Janek Ratnatunga (1997) “Traditional and Activity Based Costing Systems, Accounting Education, 6(4): 337-345.

[2] Janek Ratnatunga (2015) “The Impact of New Technologies on the Management Accountant”, Journal of Applied Management Accounting Research, 13 (1): 1-8.

[3] Michael S. C. Tse and Maleen Gong (2009) “Recognition of Idle Resources in Time-Driven Activity-Based Costing and Resource Consumption Accounting Models”, Journal of Applied Management Accounting Research, 7(2):41-54.

[4] For the detailed explanation of these methods see: Janek Ratnatunga (2020), Financial Modelling (5th Edition), Chapter 2, Quill Press, p. 506