Authors

Emma Hawthorne, Damien Hudson & Greg Guthridge

Consumer confidence underpins our net zero ambitions – and so boosting the customer experience is mission-critical for Australian energy providers.

In brief

- The transition to net zero risks failure unless consumers are confident, we are on the right trajectory.

- Energy providers must overlay the technical and financial with new consumer conversations.

- But when energy infrastructure is mostly invisible, providers must work harder to deliver value through innovative products and behavioural science.

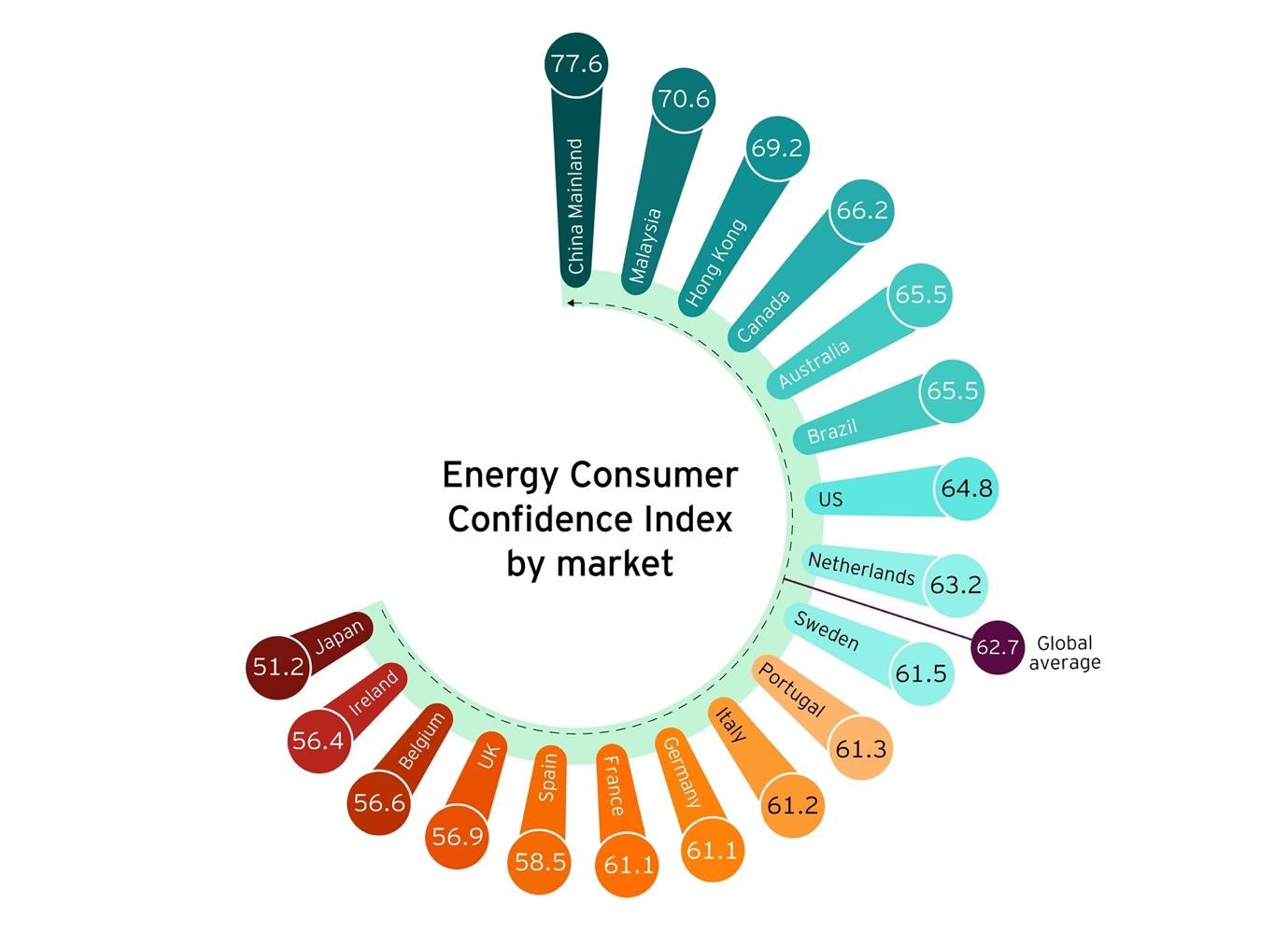

Energy providers cannot go back, stand still or even slow down. Transforming the customer experience is an imperative for survival. Rising prices, security concerns and the decarbonisation agenda have hit home for energy consumers. In fact, EY’s latest Energy Consumer Confidence Index, which surveyed 70,000 people across 18 markets, suggests that wavering consumer confidence could stall the energy transition.

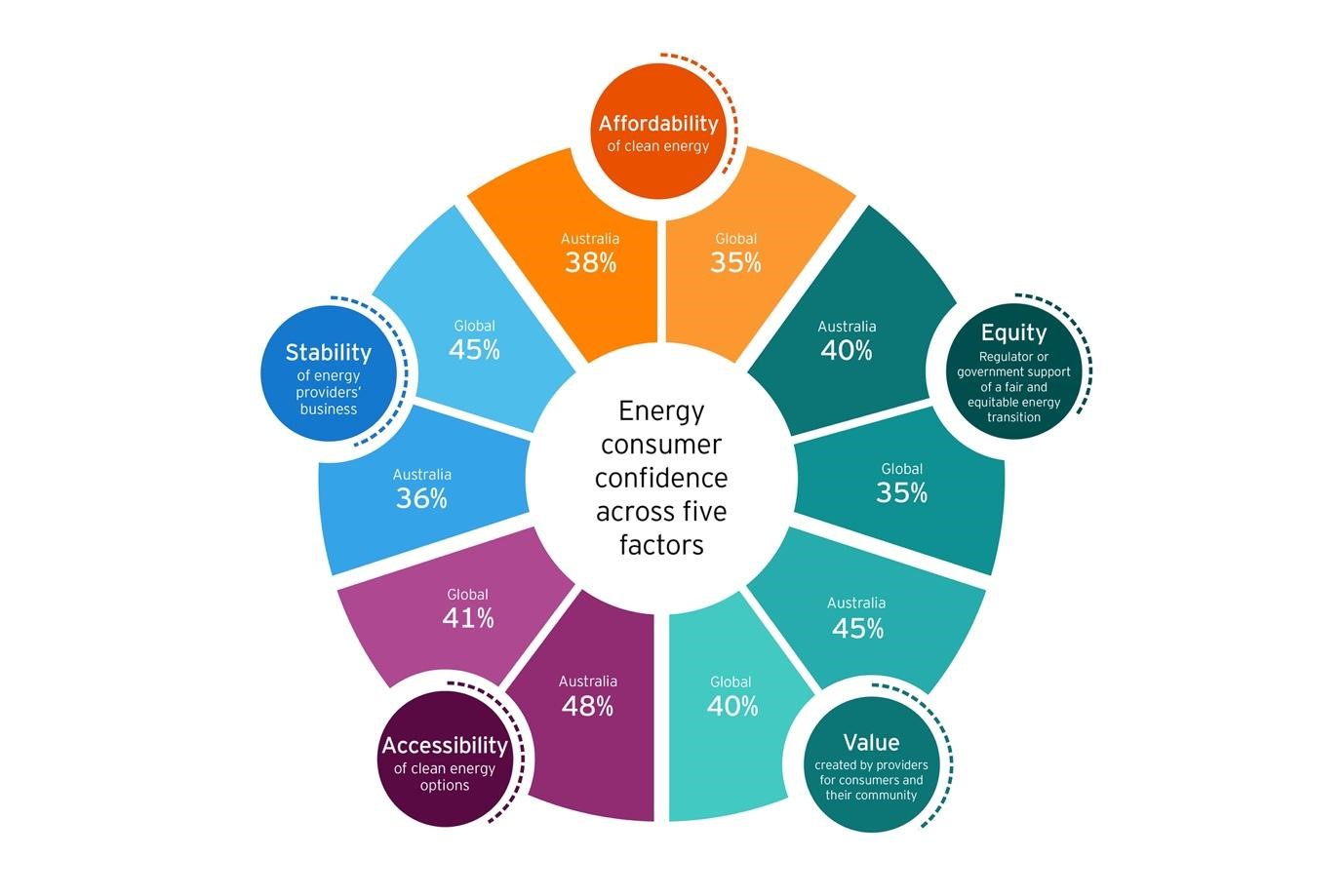

In Australia, just 38% of consumers are confident in the affordability of their energy, and, worse still, just 36% are confident in the stability of their energy provider.

We know that energy consumers are moving beyond basic expectations and their purchasing decisions are increasingly influenced by their values. But those values – for clean, green, and socially responsible energy – must align with value for money.

When nearly a third (30%) of Australians believe they are in “energy poverty”, they are unlikely to pay a premium for eco-friendly energy. So how do we support consumer confidence to maintain momentum as we move towards net zero?

Why does confidence matter to Australia’s clean energy transition?

EY’s Energy Consumer Confidence Index (ECCI) assesses consumer confidence based on five factors: the stability of energy providers’ businesses; the value that providers create for consumers and their community; the ability of consumers to access clean energy options; their ability to access affordable energy; and regulator or government support for a fair and equitable energy transition.

We determined the ECCI score by performing regression analysis to understand the factors that influence consumer confidence. Additional analysis gave us insights into how ECCI scores differed across markets and certain demographics (such as income and age). The global average ECCI is an average of the individual market scores.

The ECCI reveals the two ends of the consumer confidence spectrum. In Japan, for example, confidence is very low, with consumers facing rising energy prices, market deregulation and the lasting impact of the Fukushima nuclear disaster. Meanwhile, consumers in mainland China are extremely confident in their energy future, perhaps driven by the significant focus on, and investments in, energy infrastructure and renewables.

Energy consumer confidence is also partly driven by energy market regulation. Most markets that rank higher in the ECCI have little energy competition. In many cases, competition has brought a confusing array of consumer options and price volatility that seem to erode confidence.

Confidence is a strong predictor of consumer behaviour and investment. Confident consumers tend to be more certain about their future and more likely to spend money. The confidence of energy consumers underpins investment in new energy technologies and solutions and will either accelerate or hinder the breadth and momentum of the energy transition.

Consumer confidence is also a powerful force that aligns government policy, corporate sustainability, and personal responsibility. When consumers show a strong preference for sustainable products or services, they create a virtuous circle that influences government policies and which, in turn, encourages more corporations to prioritise sustainability.

Some of the insights from the ECCI provide a clear call to action for governments and energy providers. Consumers are struggling to see the benefits of the energy transition now and aren’t confident in future improvements either.

If energy consumer confidence wavers, then net zero pledges and clean energy ambitions are unlikely to be fully realised.

Is Australia about to move past the peak of expectation?

There is good news for Australia, which currently sits higher than our European and US peers. The ECCI score for Australia is 65.5 compared favourably against the global average of 62.7. But dig a bit deeper, and we see some clear areas of concern.

Around the globe, we have seen a consistent pattern in consumer confidence as the energy market transforms. First, consumer confidence is buoyed by future possibilities before falling sharply as the realities of scale, complexity and disruption hit home. With time, however, as the new energy market gains momentum, consumers see value in the changes around them and their confidence begins to rise once more.

The diagram above suggests Australia may have already surpassed the peak of expectation and is now facing into a period of reduced confidence as the challenges of meeting the energy trilemma of affordable, reliable, and sustainable energy grow.

When we compare local responses to global counterparts, we see a significant proportion of Australian consumers are losing faith in the security of the system, with stability a disproportionate concern. This suggest Australian consumers are yet to understand how renewables will be integrated into the grid and points to an opportunity for energy providers to engage in new conversations with their customers.

How do we enhance the energy experience and boost consumer confidence?

Change is never easy, and the energy transition requires changes to consumers’ lifestyles, homes and vehicles. The impacts are only starting to be understood, and this is influencing confidence. But the current pessimism can also be attributed to rising energy prices, uncertainty of future energy security and limited understanding of the actions and investments that they can make to be more sustainable.

EY research shows consumers’ expectations are not being met today across all aspects of the energy experience. Nearly half (47%) of Australian consumers don’t understand the actions and investment they can make to be more sustainable, and almost two thirds (63%) would like to turn to their energy provider for advice.

When consumers engage with their energy providers or others in the energy ecosystem, it is often a confusing, fragmented experience. They are unable to understand – and therefore access – the full range of support available. Energy confidence is built by getting the basics of safety and reliability right, and is further strengthened by meeting other needs, like adding value to the community.

How do Australian energy providers respond? We think there are three key actions Australian energy providers can take:

01.Be a trusted advisor to consumers on the energy transition

EY research shows that Australian energy providers are not involved in 54% of energy solution purchases. And yet, 75% of consumers want their energy provider to play a role in a new energy product and service experience. Energy providers in Australia are continuously evolving their product and service engagement and fulfilment experiences. They’ve developed innovative solutions, like green finance for home energy systems and subscription services for electric vehicles. However, the research suggests more work is ahead to simplify the consumer path to fulfilment. This starts by reinventing the energy payment experience, as the ECCI finds only 37% of consumers find it very easy to understand and pay their energy bills.

02.Target lifestyles and individual actions

Energy is just one component of consumers’ sustainable lifestyle, but nearly half of consumers surveyed are shifting their behaviours and investments towards sustainability. Energy providers can consider how they engage the consumer across an entire eco lifestyle of home, community, and society. Consumers have made small behaviour changes in the home – like consciously switching off lights when they aren’t needed or washing clothes with a full load. But they are still not focused on the actions that have the largest impact, such as turning down heating or air-conditioning, upgrading their home insulation or reducing their vehicle usage. What’s more, most are not yet looking beyond their own backyards to the impact they can make in the wider community.

People can be paradoxes and consumers’ energy-saving behaviour is complex. People often dress up action with motives they think others will consider virtuous. After taking actions they perceive as positive, many consumers store that up in a “mental piggybank” which they then spend on negative behaviours. EY’s research finds this is the case with 47% of Australians, but 65% of Gen Z consumers.

Behavioural science is a growing focus of academic research and is helping many industries to influence consumers’ actions. Behavioural scientists were put to work during the COVID-19 pandemic. Lessons learnt from successful campaigns that encouraged people to stay home, social distance, wear masks and get vaccinated, are now being applied to new areas, like sustainability. Behavioural scientists look for strategies that appeal to people’s values and emotions, encourage personal accountability, communicate desired behaviour change, and link this to good citizenship. These are all lessons we can apply to the energy transition. Focusing purely on sustainability messaging or price, without considering behavioural science, isn’t enough to drive positive consumer changes and build confidence in the energy transition.

Energy providers can respond with solutions that are easy, affordable and deliver maximum energy efficiency for the least amount of effort.

03.Value the energy intangibles

Other countries, notably those in Europe, have inspired consumer confidence while accelerating their clean energy transition by emphasising the broader benefits beyond the basics of reliability and safety. Showing how renewables and greener solutions can deliver other important consumer intangibles, like community and social impact, choice, convenience, and comfort, could be the game changer that wins consumer confidence. It won’t be easy for an industry where infrastructure investment is largely invisible to consumers. A united effort from businesses, government and community organisations can reframe messaging and inspire consumer confidence. Organisations that master this can also create differentiated value propositions and new revenue opportunities.

Counteracting Australia’s crisis of consumer confidence

With its global scope, urgency and ubiquity, the clean energy transition is arguably the largest and most complex in human history. Energy providers are right to feel daunted, especially as they must overlay the technical and financial challenges with new consumer conversations.

Summary

EY’s research suggests energy providers can’t afford to ignore consumer sentiment because it is mission critical to meeting climate targets. Even soaring investment in clean energy infrastructure won’t pave the way to a new energy future if consumers aren’t convinced that the journey will be beneficial to them. The success of the energy transition depends on consumers, so start rebuilding consumer confidence now. There’s not a moment to lose.

Authors

Emma Hawthorne

EY Associate Partner, Australian Energy

Damien Hudson

EY Partner, Digital and Emerging Technology

Greg Guthridge

EY Global Energy & Resources Customer Experience Transformation Leader

Contributors