Graduate Management Accountant (GMA) Program Overview

Entry Requirements

Graduate Management Accountant (GMA) and Associate Management Accountant (AMA) membership can be obtained by completing a Degree in Accounting, Commerce or Finance, or an MBA, from a recognised university (see FAQ) or obtaining a Professional Qualification in Accounting/Finance. For GMA membership there is no experience requirements. For AMA membership, experience is obtined either by the completion of the CMA preparatory program (2 subjects) or by completing 3 years of relevant business experience.

GMA Program Overview

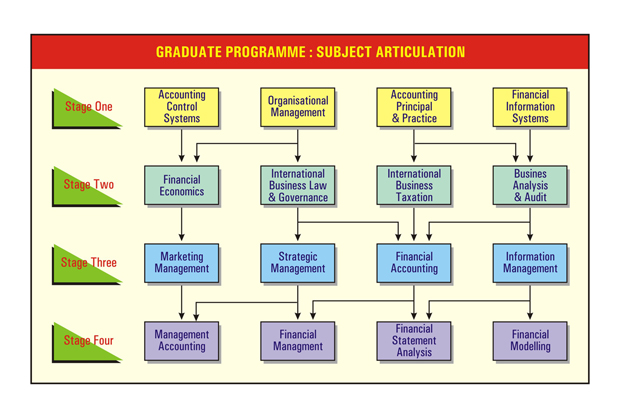

There are four stages in the Graduate Member programme, each stage requiring the passing of four subjects. A detailed list of the subjects is provided in Figure 2, and Figure 3 below shows the articulation process with each stage leading naturally to the next one, and building on what has been learnt in previous stages.

The GMA Conversion Program

To join as a Graduate Management Accountant (GMA) via the GMA Conversion Program, the student must complete Stage 4 of the graduate program (4 subjects).These subjects may be undertaken directly (without completing Stage 1 to 3) by holders of a degree in any discipline or a professional qualification in any discipline other than accounting. These subjects are taught at the honours/masters level.

Partially Completed Studies

Students who have partially completed programmes at universities, recognised professional bodies and other educational and training establishments may apply for credit, on a subject-by-subject basis. Further, it is one of the objectives of the Institute to accredit Graduate Conversion Programmes offered to non-accountants to convert to accountancy at recognised universities and educational bodies. Holders of Graduate Diplomas in Accounting and above, will be thus eligible for Graduate membership in the Institute.

The Institute’s own Graduate Conversion Programme, consists the four subjects of Stage 4 in Figure above, taught at a University 4th Year (Honours/Graduate Diploma) level.

Certified Accounting Technician Program (GMA Program Stage 1)

Objectives :

On completion of this subject students should have an understanding and appreciation of the managerial role and the contribution managers make to organisational effectiveness; within a financial services context; have an understanding of the major managerial strategy and functions; demonstrate an awareness of the major behavioural science theories and concepts relating to the behaviour and communication in the workplace, performance and productivity of individuals and groups in organisations; be capable of formulating and critically evaluating alternative courses if managerial action; be able to analyse organisational situations using the knowledge and frameworks gained during the course in order to better understand, work as part of a team and predict and influence the behaviour of individuals and groups within organisations. Students should also be able to use technology in the workplace, apply health and safety practices and be able to resolve customer complaints in the workplace.

Synopsis :

- explain the concept of strategy and its importance for organisational success

- contribute effectively to successful management of change, enlightened human resource policies and orderly organisational development

- contribute to the framing of appropriate human resource policies for the business and finance functions, to meet the organisation’s objectives.

This subject covers the six industry core units applicable from Certificate III in Financial Services (Accounts Clerical) in the Australian Qualifications Framework. As such, those possessing Certificate III qualifications will be given Recognised Prior Learning (RPL) credit in this unit.

The six industry core units are :

FNBFS01B Work within a Financial Services Context

FNBFS02A Communication in the Workplace

FNBFS03B Work as part of a Team

FNBFS04B Use Technology in the Workplace

FNBFS05A Apply Health and Safety Practices in the Workplace

FNBFS06B Resolve Customer Complaints

Objectives :

On completion of this subject, students should be able to understand how to prepare accounting records including profit and loss statements and balance sheets under the accrual concept of accounting for different types of business organisations. The nature purpose and limitations of accounting reports and the use of accounting information in decision-making is also covered.

Synopsis :

- explain the operation of financial accounting systems (manual and computerised) and prepare simple financial statements for incorporated and unincorporated businesses.

- relate basic accounting concepts to financial accounting

- interpret simple financial statements and draw conclusions

- read the accounts of a company (without and with subsidiaries or associates)

- understand the reasons establishing internal control system.

This subject covers the following competency units of the Financial Services Training Package (FNB 99) of the Australian Qualifications Framework:

FNBACC04B Prepare Financial Reports for a Reporting Entity

FNBACC06B Implement and Maintain Internal Control Procedures

FNBACC28A Prepare Complex Corporate Financial Reports

FNBACC31A Prepare Financial Statements

Objectives :

On completion of this subject students should understand how a variety of costing systems are designed and implemented in manufacturing, merchandising and service industries; appreciate the differences and conflicts between financial accounting and management accounting information systems and demonstrate the flow of costs through inventory, payroll and overhead accounts into the profit and loss statements. Students should also have a sound understanding of implementing organizational improvement programs.

Synopsis :

- understand how component elements of cost make up the total cost of an activity, service or product

- prepare cost accounting records and statements of profit for management from cost accounting records in particular operational environments

- explain the purpose of various cost accounting methods and activities, and their relevance to management and decision making

- recognise when a quantitative approach is applicable use quantitative methods to obtain accurate and reliable management information; explain and present results.

- implement organizational improvement programs.

This subject covers the following competency units of the Financial Services Training Package (FNB 99) of the Australian Qualifications Framework :

FNBACC03B Manage Budgets and Forecasts

FNBACC12B Implement Organizational Improvement Programs

FNBACC23A Produce Job Costing Information

FNBACC24A Prepare Operational Budgets

FNBACC27A Prepare & Analyse Management Accounting Information

FNBACC30A Provide Management Accounting Information

Objectives :

On completion of this subject students should have developed an understanding of information technology and its use in a business environment; the concepts behind a comprehensive accounting package; the role of databases in business computing; the internal control issues relating to computers; the specification and selection issues for major computer systems; the impact of information technology on business processes; the preparation, uses, characteristics and limitations of financial models; advanced logic within financial models; the principles of structured programming in spreadsheet macro languages; designing, testing; debugging, coding and documenting macro programs.

Synopsis :

- explain how business information systems are structured, and the reasons for differing structures

- explain the influences of information technology on business organization

- comment on the impact of information technology on business organisations.

This subject covers the following competency units of the Financial Services Training Package (FNB 99) of the Australian Qualifications Framework :

FNBACC32A Maintain Asset and Inventory Records

BSBADM404A Develop and Use Complex Databases

FNBACC21A Setup and Operate a Computerised Accounting System

BSBRKG403A Setup Records System for Small Business

FNBACC05B Establish and Maintain Accounting Information Systems

Registered Cost Accountant Program (GMA Program Stage 2)

Objectives :

On completion of this subject students should have a basic understanding of the methodology and principles of economics; have a basic understanding of micro and macroeconomics; be able to present arguments and make decisions in the economic environment. The techniques available to evaluate financial performance and risk are also covered.

Synopsis :

- describe the economic and financial environment within which businesses and government organisations operate

- explain how market systems operate and the role of specialist institutions within the markets

- appreciate reports in the financial press about economic developments, the financial markets and their implications for industry and commerce

- understand the techniques available to evaluate financial performance and risk.

This subject covers the following competency units of the Financial Services Training Package (FNB 99) of the Australian Qualifications Framework :

FNBFIN70A Prepare Financial Forecasts and Projections (microeconomics)

FNBACC17B Develop and Implement Financial Strategies (macroeconomics)

FNBACC15B Evaluate Organisation’s Financial Performance

FNBACC16B Evaluate Financial Risk

Objectives :

On completion of this subject students should be able to appreciate alternative business enterprises internationally, namely sole proprietorships, partnerships, companies and trusts; recognise the general laws which apply to such business entities internationally and appreciate the development of corporate governance regulation in different countries. The applicable comparative legislation is that of the country the student is sitting the examinations in.

Synopsis :

- explain the principles of business law which underpin competence in management accounting

- apply legal principles to business problems

- advise managers and directors on the main legal issues which arise in the course of a management accountant’s work.

- understand the need for corporate governance regulation.

This subject covers the following competency units of the Financial Services Training Package (FNB 99) of the Australian Qualifications Framework :

FNBACC29A Make Decisions within a Legal Context

BSBSBM401A Establish Business and Legal Requirements

FNBACC11B Monitor Corporate Governance

Objectives :

On completion of this subject students should be able to revise basic mathematical concepts and skills so that they are able to understand and perform a wide variety of basic mathematical processes that are necessary for analyzing business operations; become competent in the basic use of statistical tools and techniques their applications to solve problems in business; and become competent in the use of statistical data in order to be more effective in business planning, forecasting, performance evaluation, auditing and management.

Synopsis :

- appreciate the basic management of operations

- apply relevant management science techniques in practical business situations

- understand how some techniques of managerial economics are used in business decision making

- derive management information from data using computers where appropriate to help solve problems.

- use statistical information in numerous business applications such as planning, forecasting, performance evaluation, and internal auditing.

This subject covers the following competency units of the Financial Services Training Package (FNB 99) of the Australian Qualifications Framework :

BSBCMN405A Analyse and Present Research Information

FNBACC01B Provide Financial and Business Performance Information

FNBACC14B Evaluate Business Performance

FNBACC13B Conduct Internal Audit

FNBACC09B Audit/Report on Systems/Records

Objectives :

On completion of this subject students should be able to appreciate alternative business enterprises internationally, namely sole proprietorships, partnerships, companies and trusts; recognise the general laws which apply to such business entities internationally and appreciate the development of corporate governance regulation in different countries. The applicable comparative legislation is that of the country the student is sitting the examinations in.

Synopsis :

- explain the principles of business law which underpin competence in management accounting

- apply legal principles to business problems

- advise managers and directors on the main legal issues which arise in the course of a management accountant’s work.

- understand the need for corporate governance regulation.

This subject covers the following competency units of the Financial Services Training Package (FNB 99) of the Australian Qualifications Framework :

FNBACC29A Make Decisions within a Legal Context

BSBSBM401A Establish Business and Legal Requirements

FNBACC11B Monitor Corporate Governance

Registered Business Accountant (GMA Program Stage 3)

Objectives :

On completion of this subject students should possess a thorough knowledge of the content of the reports of publicly listed companies and be able to prepare such reports and regulations of the various regulatory bodies; be aware of current issues in financial reporting and be cognisant of current changes in disclosure requirements and be able to critically evaluate such proposed changes.

Synopsis :

- prepare financial accounts for organisations in both the private and public sector

- measure financial performance of organisations

- explain the process of financial regulation in the preparation of accounts

- explain the influence of price level changes on financial accounts.

Objectives :

This subject aims to provide students with the foundation for differentiating marketing from other organisational functions by fostering an understanding of markets, marketing concepts, key marketing issues and the relationship of these to society as a whole. This framework enables students to link their knowledge with the practicalities of marketing.

Synopsis :

- understand the nature and role of marketing

- consider marketing in organisations and the environment of marketing

- study consumer behaviour, industrial buyer behaviour, and market segmentation

- consider pricing policy and the development of a marketing plan

- explain retailing, wholesaling and international marketing

- measure the impact of promotion and communication.

Objectives :

The aim of this subject is to develop an understanding of information technology (IT) and its significance for managers; to explore how information technology and electronic commerce enable changes to the skills, work practices, structures and culture of organisations; to understand how information technology can enhance an organisation’s business strategies, increase business opportunities and create a competitive advantage; to understand how information technology affects an organisation’s clients, customers, suppliers and the community as well as staff, to enable managers to combine information and communication technology expertise with general management skills; to allow managers to direct and co-operate with information systems professional and colleagues in identifying, selecting and managing their organisation’s information systems.

Synopsis :

- understand the technology

- define, develop and implement information systems

- manage information resources including data and technology in compliance with technical, operational and legal requirements to meet user needs

- advise management on the development of information strategies

- utilize information (uncertain and imperfect) to support management activities of planning and decision making

- monitor and control information systems and services.

Objectives :

On completion of this subject students should be able to understand the dynamic nature of business and the strategic management process employed to gain sustainable competitive advantage. Students will be able to apply and integrate general business skills and techniques to strategic problem solving, and to communicate concisely and cogently the analysis and recommended solutions to strategic problems.

Synopsis :

- analyse business environments including markets and critical success factors

- undertake strengths, weaknesses, opportunities, threats (SWOT) analyses’

- determine corporate objectives, strategies and structures for strategy implementation

- undertake structural analyses of industries for competitive advantage.

Graduate Conversion Program (GMA Program Stage 4)

Objectives :

On completion of this subject students should be able to apply capital budgeting principles and techniques to investment proposals in order to facilitate optimum decision-making, understand the risk/return trade-off inherent in portfolio analysis and selection; understand how to apply techniques suitable for valuing various debt and equity securities; examine and evaluate empirical research relating to the optimum financial structure of the firm; understand the nature, purpose and limitations of financial ratios and other data to evaluate performance and credit risks; examine and understand empirical research relating to the concept of market efficiency; examine and evaluate empirical research relating to the optimum dividend policy of the firm.

Synopsis :

- find, use, and manage funds in different organisations

- select and evaluate techniques used in treasury management and investment decision making

- analyse the changing, competitive business environment in order to formulate financial strategy.

Objectives :

This subject seeks to describe and explain the properties of financial statement numbers, the key aspects of decisions that use financial statement information, and the features of the environment in which these decisions are made.

Synopsis :

- understand the demand and supply forces of corporate financial disclosure

- apply analytical techniques such as common-sized statements and ratio analysis

- consider accounting method choice on accounting numbers

- undertake correlational and cross-sectional analysis of Financial Statements

- consider the impact of times series properties of financial statement numbers.

Objectives :

On completion of this subject students should be able to appreciate the role of computers in analysing the financial activities of a business and in decision support; appreciate the problems involved in the implementation of computerised financial models and spreadsheets; recognise the ways in which computer-based financial models may be used by management and evaluate commercially available financial modeling software.

Synopsis :

- apply cost accounting principles and techniques to model in all kinds of organisations

- analyse and critically evaluate information for cost ascertainment, planning, control and decision making

- model and interpret cost accounting and other financial statements.

Objectives :

On completion of this subject students should be able to understand the decision making requirements and the information needs of management; apply management accounting principles and techniques to a wide range of situations in both service and manufacturing industries; appreciate recent developments in the theory and practice of management accounting, control systems; and appreciate the developments information technology in relation to the provision of management accounting information.

Synopsis :

- select and utilise control systems which provide management control of the organisation

- provide management with appropriate information for control, assessing and reporting on performance, monitoring efficiency, effectiveness and value for money

- evaluate and audit the relevance of management information systems (including information technology systems)

- advise management on the use of these systems, and on issues of personal or corporate conduct.

- Prof Janek Ratnatunga on “Future Proofing Indonesian Companies”

- Adele Ferguson on the “Travails of an Investigative Journalist”

- Prof Rod Sims on the “Reminisces of a Competition Regulator”

- Don Rankin on “Professional Advice and Business Start-Ups”

- Simon Griffiths on “Who Gives a Crap about a Social Purpose”

Stay In Touch