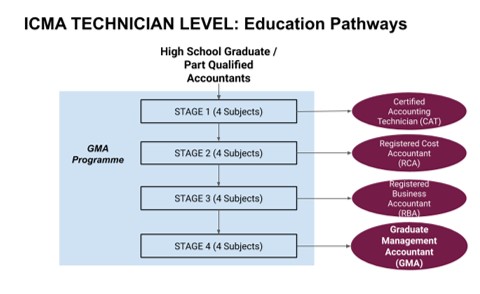

These programmes cover the three technician-level qualifications of ICMA:

- Certified Accounting Technician (CAT)

- Registered Cost Accountant (RCA)

- Registered Business Accountant (RBA)

An overview of the Technician Level programme is illustrated in the following figure.

Syllabi

There are 3-Stages in the Technician-Level Programs, plus the Graduate Level Stage 4, consisting of 4-Subjects each.

Stage 1 Certified Accounting Technician (CAT)

This has been assessed at Level 4 (Certificate) in the New Zealand Qualifications Framework (NZQF)

Organizational Management

Accounting Principles & Practice

Accounting Control Systems

Financial Information Systems

Stage 2 Registered Cost Accountant (RCA)

This has been assessed at Level 5 (Diploma) in the New Zealand Qualifications Framework (NZQF)

Financial Economics

International Business Law & Governance

Business Analysis & Audit

International Business Taxation

Stage 3 Registered Business Accountant (RBA)

This has been assessed at Level 6 (Advanced Diploma) in the New Zealand Qualifications Framework (NZQF)

Financial Accounting

Marketing Management

Information Management

Strategic Management

On completion of Stege 3 (or equivalent) students can progress to the Graduate Management Accountant (GMA). Professional qualification.

Stage 4 Graduate Management Accountant (GMA)

This has been assessed at Level 7 (Bachelor’s Degree) in the New Zealand Qualifications Framework (NZQF)

Financial Management

Financial Statement Analysis

Financial Modelling

Managerial Accounting

Entry Requirements

High school graduates with a pass level at a Country (or State) administered university entrance examination (e.g. TER, SAT, IB or ‘A’ Levels) (or equivalent), may apply to undertake ICMA’s Technician-level programmes. Those holding a Diploma in Accounting are eligible to join at the Registered Cost Accountant (RCA) level and those holding a Advanced Diploma in Accounting are eligible to join at the Registered Business Accountant (RBA) level. Part qualified student members of recognized professional accounting bodies (e.g. CA, CPA, CIMA, ACCA etc.) would also be eligible for this pathway at a suitable entry point as determined by ICMA, based on the percentage of part-completion obtained. To join as a Graduate Management Accountant (GMA), the student must obtain a degree in any discipline after the completion of the graduate-level program.

Practical Experience Requirements

No practical experience is required to obtain membership at any of the stages of the Technician-level programs and for the Graduate Management Accountant (GMA) certification and membership. Note however, a degree (in any discipline) is required for GMA certification.

Stay In Touch